Class 10 SELINA Solutions Maths Chapter 1 - GST [Goods and Services Tax]

Learning with the best resources helps accelerate exam prep. With Chapter-wise Selina solutions for class 10 Chapter 1 - GST [Goods And Services Tax] access the step-by-step answers rightfully explained for every question covered in Selina's textbook.

The subject matter experts at TopperLearning are well-experienced and have gone through the entire ICSE Class 10 Math syllabus to come up with the best solutions. A browse through the answers will help you with the best of your understanding of various GST [Goods And Services Tax] concepts. Taxes are computed on the cost of purchase of goods or services or both. The percentage is pronounced by the government. The Chapter 1 solutions will present students with a brief idea about the computation of such taxes. If you find it challenging to solve the problems of this Chapter, refer to Selina Solutions that make self-paced learning experience a seamless one. You will be able to complete the various exercises in the Maths textbook on your own at any point of time throughout the day.

The main aim of TopperLearning is to help you with the best guidance across all subjects in ICSE Class 10. If you are searching for specific Selina solutions, here you will get accurate textbook solutions (Selina) for Physics, Biology and Chemistry. Once you are sorted with your Class 10 Science part, you can browse the website for solutions to Hindi, English, Economics and Social Studies textbook questions.

Preparing for your board exams is not a cakewalk and requires the right type of planning to score the maximum grades. At TopperLearning, you can expect the best. Here, everything is explained - the ICSE Class 10 syllabus, video lessons, previous year's question paper with solutions, sample papers and solutions, and revision notes.

GST [Goods and Services Tax] Exercise Ex. 1(A)

Solution 1

MRP = Rs. 12,000, Discount % = 30%, GST = 18%

Discount = 30% of 12,000 = ![]()

Selling price (discounted value) = 12000 - 3600 = Rs. 8400

CGST = 9% of 8400 = Rs. 756

SGST = 9% of 8400 = Rs. 756

IGST = 0

Amount of Bill = Selling price + CGST + SGST = 8400 + 756 + 756 = Rs. 9912

Solution 2

MRP = Rs. 50,000, Discount % = 20%, GST = 28%

Discount = 20% of 50,000 = ![]()

Selling price (discounted value) = 50,000 - 10,000 = Rs. 40,000

CGST = 0

SGST = 0

IGST = 28% of 40,000 = ![]()

Amount of Bill = Selling price + IGST = 40,000 + 11,200 = Rs. 51,200

Solution 3

|

Name of the person |

Repairing cost (in Rs.) |

Discount % |

Discount |

Selling price |

CGST (9%) |

SGST (9%) |

|

A |

5500 |

30 |

1650 |

3850 |

346.5 |

346.5 |

|

B |

6250 |

40 |

2500 |

3750 |

337.5 |

337.5 |

|

C |

4800 |

30 |

1440 |

3360 |

302.4 |

302.4 |

|

D |

7200 |

20 |

1440 |

5760 |

518.4 |

518.4 |

|

E |

3500 |

40 |

1400 |

2100 |

189 |

189 |

|

Total |

|

|

|

18,820 |

1693.8 |

1693.8 |

The total money (including GST) received by the mechanic is 18,820 + 1693.8 + 1693.8 = Rs. 22,207.6

Solution 4

|

Quantity |

MRP |

Total MRP |

Discount % |

Discounted price |

Selling price |

CGST 2.5% |

SGST 2.5% |

|

36 |

450 |

16200 |

10 |

1620 |

14580 |

364.5 |

364.5 |

|

48 |

720 |

34560 |

20 |

6912 |

27648 |

691.2 |

691.2 |

|

60 |

300 |

18000 |

30 |

5400 |

12600 |

315 |

315 |

|

24 |

360 |

8640 |

20 |

1728 |

6912 |

172.8 |

172.8 |

|

Total |

|

|

|

|

61740 | 1543.5 | 1543.5 |

Amount of bill = Selling price + GST

= Rs. 61740 + Rs. 1543.5 + Rs. 1543.5

= Rs. 64827

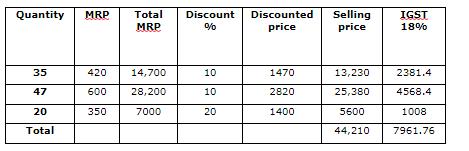

Solution 5

Amount of bill = Selling price + IGST

= 44,210 + 7961.76

= Rs. 52,167.8

Solution 6

|

MRP (in Rs.) |

Discount % |

CGST % |

Discounted value |

Selling price |

CGST |

SGST |

|

12,000 |

30 |

6 |

3600 |

8400 |

504 |

504 |

|

15,000 |

20 |

9 |

3000 |

12,000 |

1080 |

1080 |

|

9500 |

30 |

14 |

2850 |

6650 |

931 |

931 |

|

18,000 |

40 |

2.5 |

7200 |

10,800 |

270 |

270 |

|

|

|

|

|

37,850 |

2785 |

2785 |

Amount of bill = Selling price + CGST + SGST

= 37,850 + 2785 + 2785 = Rs. 43,420

Solution 7

|

MRP (in Rs. ) |

Discount |

Discounted value |

Selling price |

IGST |

IGST |

|

12,000 |

30 |

3600 |

8400 |

12 |

1008 |

|

15,000 |

20 |

3000 |

12,000 |

18 |

2160 |

|

9500 |

30 |

2850 |

6650 |

28 |

1862 |

|

18,000 |

40 |

7200 |

10,800 |

5 |

540 |

|

|

|

|

37,850 |

|

5570 |

Amount of bill = Selling price + GST

= 37,850 + 5570

= Rs. 43,420

Solution 8

|

Rate per piece (in Rs.) |

Quantity (no. of pieces) |

Discount % |

MRP |

Selling price |

IGST @18% |

|

180 |

10 |

Net |

1800 |

1800 |

324 |

|

260 |

20 |

20 |

5200 |

4160 |

748.8 |

|

310 |

30 |

Net |

9300 |

9300 |

1674 |

|

175 |

20 |

30 |

3500 |

2450 |

441 |

|

|

|

|

|

17,710 |

3187.8 |

Amount of bill = Selling price + IGST

= 17,710 + 3187.8

= Rs. 20,897.8

Solution 9

|

Number of services |

Cost of each service (in Rs.) |

GST % |

MRP |

IGST |

|

8 |

680 |

5 |

5440 |

272 |

|

12 |

320 |

12 |

3840 |

460.8 |

|

10 |

260 |

18 |

2600 |

468 |

|

16 |

420 |

12 |

6720 |

806.4 |

|

|

|

|

18,600 |

2007.2 |

Amount of bill = Selling price + IGST

= 18,600 + 2007.2

= Rs. 20,607.2

Solution 10

According to the question,

GST = 18% of 750

= ![]()

The amount of bill = 750 + 135 = Rs. 885

Solution 11

Let the total annual premium paid by Ms. Pratima be Rs. x. According to the question, 18% of x = SGST + CGST 18% of x = 1800 ![]() SGST = CGST

SGST = CGST ![]() x = Rs. 10,000

x = Rs. 10,000

Solution 12

According to the question,

The amount of bill = 5000 × 2 + 1000 + 1000

= 10,000 + 2000

= Rs. 12,000

GST = 28% of 12,000

= ![]()

GST charged by Mr. Malik Rs. 3360.

Solution 13

According to the question,

GST on ticket of Rs. 80 = 18% of 80 = ![]()

GST on ticket of Rs. 120 = 28% of 120 = ![]()

Difference between both GST = 33.60 - 14.40 = Rs. 19.20

Solution 14

Let the selling price of an A.C. = Rs. x

∴ x + 28% of x = 31200

⇒ x = Rs. 24375

⇒ Price of an A.C. without GST = Rs. 24375

(i)

GST = 28%

Total amount of GST = 28% of 24375 = Rs. 6825

(ii)

Taxable value of A.C. = Rs. 24375

(iii)

Amount of CGST = GST/2 = Rs. 3412.5

(iv)

Amount of SGST = GST/2 = Rs. 3412.5

GST [Goods and Services Tax] Exercise Ex. 1(B)

Solution 1

When the goods/services are sold for Rs. 15,000 under intra-state transaction from station A to station B and the rate of GST is 12%.

As per GST System

- S.P. (excluding GST) at station A = Rs. 15,000

- CGST = 6% of 15,000 = Rs. 900

SGST = 6% of 15,000 = Rs. 900 - C.P. (excluding GST) at station B = Rs. 15,000

- If profit = Rs. 5000

S.P. at station B = 15,000 + 5000 = Rs. 20,000

Now the same goods/services are moved under inter-state transaction from station B to station C and the b rate of tax is 12%. - GST = 12% of 20,000 = Rs. 2400

- C.P. (excluding GST) at station C = Rs. 20,000

Solution 2

When the product is sold from Agra to Kanpur (intra-state transaction)

For the dealer in Agra :

S. P. in Agra = Rs. 20,000

CGST = 9% of Rs. 20,000 = ![]()

SGST = 9% of Rs. 20,000 = ![]()

When product is sold from Kanpur to Jaipur (inter-state transaction)

For the dealer in Kanpur

Input-tax credit = 1800 + 1800 = Rs. 3600

C. P. = Rs. 20,000 and Profit = Rs. 5000

S.P. = 20,000 + 5000 = Rs. 25,000

IGST = 18% of 25,000 = Rs. 4500

Net GST paid by the dealer at Kanpur

= Output GST - Input GST

= 4500 - 3600

= Rs. 900

Solution 3

For the dealer in Mumbai (inter-state transaction)

CP = Rs. 20,000

IGST = 12% of Rs. 20,000 = ![]()

Profit = Rs. 5000

SP = Rs. 25,000

For the dealer in Pune (intra-state transaction)

CP = Rs. 25,000

CGST = 6% of 25,000 = Rs. 1500

SGST = 6% of 25,000 = Rs. 1500

GST payable by the end user at Pune = 1500 + 1500 = Rs. 3000

Solution 4

For the dealer A (intra-state transaction)

SP = Rs. 8,000

For the dealer B (intra-state transaction)

CP = Rs. 8,000

CGST = 9% of 8,000 = Rs. 720

SGST = 9% of 8,000 = Rs. 720

Profit = Rs. 1,200

SP = Rs. 9,200

For the dealer C (inter-state transaction)

CP = Rs. 9,200

IGST = 18 % of Rs. 9,200 = ![]()

Input Tax = Rs. 1,656

Since, the dealer in Patna does not sell the product.

Output GST (tax on sale) = Rs. 0

Solution 5

For A (case of inter-state transaction)

S.P. in Meerut = Rs. 15,000

For B (case of inter-state transaction)

C.P.= Rs. 15,000

IGST = 18% of 15,000 = ![]()

Input tax for B = Rs. 2,700

S.P. in Ratlam = 15,000 + 3000 = Rs. 18,000

For C (case of intra-state transaction)

C.P.= Rs. 18,000

CGST = 9% of 18,000 = ![]()

SGST = ![]()

Out put tax for B = Rs. 1620 + Rs. 1620 = Rs. 3240

Net GST payable by the dealer B

= Output tax - Input tax

= 1620 + 1620 - 2700

= Rs. 540

Cost for the dealer C in Jabalpur

= S.P. for the dealer in Ratlam + GST

= 18,000 + 1620 + 1620

= Rs. 21,240

Solution 6

For the dealer X (intra-state transaction)

SP = Rs. 50,000

For the dealer Y (intra-state transaction)

CP = Rs. 50,000

CGST = 14% of 50,000 = Rs. 7,000

SGST = 14% of 50,000 = Rs. 7,000

Input tax for dealer Y = Rs. 14,000

Profit = Rs. 20,000

SP = Rs. 70,000

For the dealer Z (inter-state transaction)

CP = Rs. 70,000

IGST = 28 % of Rs. 70,000 = ![]()

∴ Input Tax = Rs. 19,600 which is the output tax for dealer Y.

Net GST payable for Y

= Output tax for Y - Input tax for Y

= 19,600 - 14,000

= Rs. 5600

Solution 7

- Output tax in Delhi (interstate) :

IGST = 9% of 50,000 = Rs. 9000

Output tax in Delhi = Rs. 9000 - Output tax in Kolkata :

C.P. in Kolkata = Rs. 50,000 and Profit = Rs. 20,000

S.P. in Kolkata = 50,000 + 20,000 = Rs. 70,000

IGST = 18% of 70,000 = Rs. 12,600

Output tax in Kolkata = Rs. 12,600 - Since, the dealer in Nainital does not sell the product.

Output GST (tax on sale) = Rs. 0

Solution 8

Initial marked price by manufacturer A is Rs. 6000

B bought the T.V. at a discount of 20%.

Cost price of B = 80% of 6000 = Rs. 4800 ….(i)

GST paid by B for purchase = 18% of 4800 = Rs. 864 ….(ii)

B sells T.V. at discount of 10% of market Price

Selling price for B = 6000 - 10% of 6000 = Rs. 5400 …(iii)

GST charged by B on selling of T.V. = 18% of 5400

= Rs. 972 …(iv)

GST paid by B to the government

= GST charged on selling price - GST paid against purchase price

= 972 - 864

= Rs. 108

Solution 9

Initial marked price by manufacturer A is Rs. 75,000

B bought the T.V. at a discount of 30%.

Cost price of B = 70% of 75,000 = Rs. 52,500 ….(i)

GST paid by B for purchase = 5% of 52,500 = Rs. 2625 ….(ii)

B sells T.V. by increasing marked price by 30%.

Selling price for B = 75,000 + 30% of 75,000 = Rs. 97,500 …(iii)

GST charged by B on selling of T.V. = 5% of 97,500

= Rs. 4875 …(iv)

GST paid by B to the government

= GST charged on selling price - GST paid against purchase price

= 4875 - 2625

= Rs. 2250

Solution 10

Marked price = Rs. 15,680

GST = 12% of 15,680 = Rs. 1881.6

Total price including GST = Rs. 17561.6

Price Gagan willing to pay including GST = Rs. 15,680

Let the reduced price be Rs. x, then

x + 12% of x = 15,680

x = Rs. 14000

Hence reduction in marked price = 15,680 - 14000 = Rs. 1,680

Solution 11

For the wholesaler:

Marked price = Rs. 45000

Discount = 10% = Rs. 4500

S.P. = M.P. - Discount

= 45000 - 4500

= Rs. 40500

For the dealer:

C.P. = Rs. 40500

Discount = 4% of 45000 = Rs. 1800

S.P. = M.P. - Discount

= Rs. 45000 - Rs. 1800

= Rs. 43200

(i)

Tax paid by the dealer to the central government

= Output tax - Input tax

= Tax on S.P. - Tax on C.P.

= 18% of 43200 - 18% of 40500

= 7776 - 7290

= Rs. 486

Since, the transaction is inter-state.

Tax paid by the dealer to the state government = Rs. 0

(ii)

GST paid by the dealer = 18% of 43200 = Rs. 7776

∴ GST received by the central government = 7776

Since, the transaction is inter-state.

So, GST received by the state government = Rs. 0

(iii)

For the consumer:

C.P. = S.P. for dealer = Rs. 43200

GST paid by the consumer = 18% of 43200 = 7776

∴ Total amount paid by the consumer = Rs. 50976

Solution 12

For Rohit:

Input tax = Rs. 10,400

Output tax = Rs. 11,000

GST paid by Rohit = Output tax - Input tax = Rs. 600

SGST = CGST = Rs. 300

For Manish:

Input tax = Rs. 11000

Output tax = Rs. 11800

∴ GST paid by Manish = 11800 - 11000 = Rs. 800

∴ SGST = CGST = Rs. 400

Solution 13

(i)

Marked price of T.V. = 25000 + 20% of 25000 = Rs. 30000

(ii)

Marked price = Rs. 30000

Discount = 10% = Rs. 3000

∴ Cost price for consumer without tax = 30000 - 3000 = Rs. 27000

GST paid by the consumer = 12% of 27000 = Rs. 3240

∴ Consumer's cost price of TV inclusive of tax under GST = Rs. (27000 + 3240) = Rs. 30240

(iii)

For the retailer:

Input tax = 12% of 25000 = Rs. 3000

Output tax = 12% of 27000 = Rs. 3240

GST paid by the retailer to the Central and State Governments = Output tax - Input tax

= Rs. (3240 - 3000)

= Rs. 240

Solution 14

Marked price of an article = Rs. 6000

For the dealer:

Discount = 30%

C.P. = M.P. - 30% of M.P. = Rs. 4200

(i)

For the consumer:

M.P. = Rs. 6,000

Discount = 10%

C.P. = M.P. - 10% of M.P. = Rs. 5400

GST paid by the consumer = 5% of 5400 = Rs. 270

∴ The total amount paid by the consumer for the article = 5400 + 270 = Rs. 5670

(ii)

For the dealer:

Input tax = tax on purchase = 5% of 4200 = Rs. 210

Output tax = GST paid by consumer = Rs. 270

Tax under GST paid by the dealer to the central and state governments

= Output tax - Input tax

= Rs. (270 - 210)

= Rs. 60

So, tax under GST paid by the dealer to the state government is Rs. 30.

(iii)

GST received by the state and central governments = GST paid by the consumer

= Rs. 270

∴ Amount of tax under GST received by the central government is Rs. 135.

Solution 15

Marked price of an article = Rs. 20,000

(i)

For the dealer:

Cost price = Rs. 20,000

GST = 18% of Rs. 20,000 = Rs. 3600

So, the price of the article (inclusive of GST) for the shopkeeper is Rs. 23600.

(ii)

GST paid by the shopkeeper = Rs. 3600

For consumer:

Cost price = 20000 + 25% of 20000 = Rs. 25000

GST paid by the consumer = 18% of 25000 = Rs. 4500

∴ Input tax for the shopkeeper = Rs. 3600

Output tax for the shopkeeper = Rs. 4500

Tax paid by the shopkeeper to the government = Output tax - Input tax = Rs. 900.

Thus, the amount of tax, under GST, paid by the shopkeeper to the Government is Rs. 900.

Solution 16

Marked price of an A.C. = Rs. 64,000

(i)

For the distributor:

S.P. of A.C. without GST = 64000 - 25% of 64000 = Rs. 48000

GST paid = 18% of 48000 = Rs. 8640

S.P. of A.C. including GST, for the distributor = Rs. (48000 + 8640) = Rs. 56640

(ii)

GST paid by the distributor = 18% of 48000 = Rs. 8640

∴ Tax paid by the distributor to the State Government = GST/2 = Rs. 4320

(iii)

For the shopkeeper:

C.P. = S.P. for the distributor = Rs. 48000

Input tax = 18% of 48000 = Rs. 8640

Output tax = Tax paid by the consumer

C.P. for the consumer = Rs. 64000

GST paid by the consumer = 18% of 64000 = Rs. 11520

∴ Output tax = Rs. 11520

∴ Tax paid by the shopkeeper to the government = 11520 - 8640 = Rs. 2880

∴ The tax, under GST paid by the shopkeeper to the central government is Rs. 1440.

(iv)

Tax received by the state

government = SGST paid by the consumer = Rs. ![]() = Rs. 5760

= Rs. 5760

(v)

The price including tax under GST of the A.C. paid by the customer

= C.P. for the consumer + GST paid by the consumer

= 64000 + 18% of 64000

= Rs. 75520